Finding the best property agent and buying homes for sale in Turkey can be a daunting task. However, you have found us! We have the updated listing for apartments for sale in Turkey. With apartment types spanning many lifestyles, including budget homes with sea views or luxury penthouses that would please millionaires, we are sure to fit your needs perfectly - what kind of house do you desire? When you decide to buy a house in Turkey, all you need to do is check our listing for houses for sale in Turkey, and choose the one you like.

Due to its strategic location between Europe, the Middle East, and Central Asia, Turkey is one of Europe's most promising real estate markets, offering great opportunities for real estate developers and investors, with apartments being among the most sought-after types of real estate in Turkey, particularly by foreigners, either for investment or to benefit from them in order to obtain Turkish citizenship, which, according to recent revisions, can be awarded to foreigners in exchange for buying a property worth $250,000.

Apartment sales in Turkey dropped 17.0% in August compared with the same month the preceding year, totaling 141,400 apartments sold. However, Istanbul had the greatest proportion of apartment sales, with 24,286 sales accounting for 17.2%, followed by Ankara with 13,642 sales accounting for 9.6%, and Izmir with 7,731 sales accounting for 5.5%. On the other hand, Hakkari, with 16 apartments, and Ardahan, with 28 apartments, were the provinces with the lowest number of apartment sales.

In August, sales of mortgaged apartments in Turkey totaled 27,375, down 64.0% from the same month the previous year. Mortgaged apartment sales represented 19.4% of all apartment sales. With about 5,636 apartments sold at a rate of 20.6 %, Istanbul placed top in mortgage sales. On the other hand, Hakkari was the province with the lowest mortgaged apartment sales with only 1 apartment sold.

In August, other sale forms of apartments in Turkey grew by 20.8% over the same month the previous year, with 114,025 apartments sold. Istanbul came in top, accounting for 16.4% of the total with 18,650 apartments. The share of these sale forms in the total sales of apartments in Istanbul was 76.8%. With 10,178 apartments sold, Ankara came in second, followed by Izmir with 6,655 apartments sold. And again, Hakkari province had the lowest sales with just 15 apartments sold.

In August, the number of apartments sold for the first time in Turkey fell by 18.2% to 42,639 apartments sold, compared to the same month the previous year. These transactions accounted for 30.2% of all apartment sales. Istanbul had the biggest proportion, with 6,375 apartments sold; about 15.0%, followed by Ankara with 2,932 apartments sold and Izmir with 1,972.

In August, secondhand apartment sales in Turkey fell by 16.5% to 98,761 apartments, compared to the same month of the previous year. Istanbul came in first, with 17,911 apartments sold; an 18.1% increase. Istanbul accounted for 73.8% of overall house sales, with Ankara coming in second with 10,710 apartments sold, followed by Izmir with 5,759 apartments sold.

Apartment sales fell 21.7% over year to 801,995 apartments sold in the January-August period, while sales of mortgaged apartments fell 67.9% to 152,096 apartments sold, and other forms of sales rose 17.9% to 649,899 apartments sold. First-time house sales decreased 23.5% to 243,189 over this period, while second-hand home sales plummeted 20.9% to 558,806.

Foreigner apartment sales climbed by 50.7% in August compared to the same month of the previous year, totaling 5,866 apartments sold. With a total of 2,729 apartments sold, Istanbul took first position. Antalya came in second with 976 apartments sold, followed by Ankara with 400 apartments sold, Mersin with 242 apartments sold, and Yalova with 233 apartments sold.

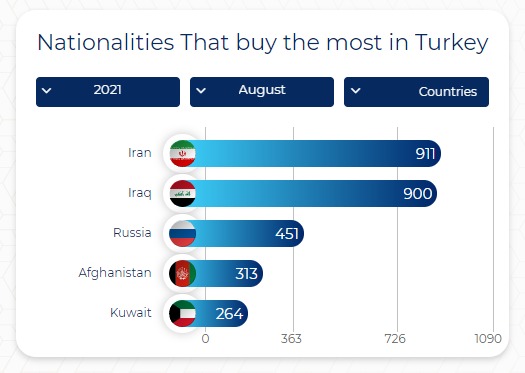

In the month of August alone, Iranian nationals bought 911 apartments in Turkey. Following the Iranians, Iraqis purchased 900 apartments, Russians took 451 apartments, Afghans had 313 apartments, and Kuwaitis had 264 apartments.

Source: data.tuik.gov.tr + euronews + sozcu

Editing: damasturk